Plains Commerce Cares

Paycheck Protection Program: Key Changes

On March 18, 2021 the Small Business Administration (SBA) released an updated set of guidance regarding the Paycheck Protection Program Second Draw Loans. Below you will find updated applications for the Paycheck Protection Program loans:

Loan Forgiveness Applications & Instructions:

PPP Loan Forgiveness Application Form 3508S Revised July 30, 2021 (PDF)

PPP Loan Forgiveness Application Form 3508EZ Revised July 30, 2021 (PDF)

PPP Loan Forgiveness Application Form 3508 Revised July 30, 2021 (PDF)

Paycheck Protection Program Borrower Application: March 18, 2021 (PDF)

Paycheck Protection Program Second Draw Borrower Application: March 18, 2021 (PDF)

For more information regarding these changes:

Business Loan Program Temporary Changes; Paycheck Protection Program as Amended by Economic Aid Act

Business Loan Program Temporary Changes; Paycheck Protection Program Second Draw Loans

US Treasury and IRS begin delivering second round of Economic Impact Payments

Leaders in the House and Senate have agreed upon a COVID-19 relief bill, which includes a second round of stimulus checks in the amount of $600 per adult and dependent children, subject to income limits. These payments are expected to follow income phase-out limits as it was in the original CARES Act. The first wave of checks is set to be direct deposited into accounts beginning the week of January 4, 2021. Prepaid cards, paper check, and additional direct deposits will arrive in the following weeks.

Get an update on payment distribution

Important COVID-19 Updates

At Plains Commerce Bank, our first priority will always be the health and safety of our customers, our employees, and their families. We continue to monitor daily news developments and CDC recommendations and below you’ll find important information and resources as we transition back to our new “normal”.

Paycheck Protection Program (PPP)

As a vital piece to the COVID-19 stimulus package, the Paycheck Protection Program (PPP)* is set to provide a short-term lending vehicle for any employers to help keep their employees in place in hopes to avoid of avoiding long-term unemployment.

PPP loans may be used for a variety of purposes

Paycheck Protection Application

Paycheck Protection Program Details

Loan Forgiveness and Instructions

Instructions for completing SBA Form 3508S

Loan Forgiveness Application (SBA Form 3508S)

Instructions for completing SBA Form 3508

Amended Loan Forgiveness Application (SBA Form 3508)

Instructions for Completing SBA FORM 3508 EZ

Loan Forgiveness Application for Qualifying Businesses (SBA Form 3508 EZ)

PPP Loan Forgiveness Checklist

Summary of the Forgiveness Application

Congress unanimously passed legislation that could ease restrictions on how businesses are able to use their funds received from the PPP hoping to make loan forgiveness more accessible. Please note that further guidance and clarification from the SBA and Treasury is likely.

Paycheck Protection Program Flexibility Act of 2020 highlights are as follows:

Steps Borrowers Should Take Now

Bank From Anywhere

Online and mobile banking options make banking from work or home easier than ever—especially when you’re feeling ill. Skip the trip and set up automatic payments, make a deposit, transfer funds, and other conveniences right from your device.

Mobile Banking Benefits

Online Banking Benefits

Branch Lobby Reopening Details

As our branch lobbies are now open, we ask that you first make an appointment by contacting a banker as it’s the best way for us to maintain health and safety measures.

Prior to visiting a branch, please review and follow these best practices

1. Enter the branch only if you feel well

2. Maintain social distancing

3. Wash and sanitize your hands

4. Limit contact

We're here to help. Please contact your banker for additional information regarding these resources.

Contact Us

To contact us, Contact UsCommerce Community Checking

We’re committed to supporting and helping improve our local communities, small businesses, and organizations that spend their days helping others. That’s why we developed Commerce Community Checking—a program developed specifically for sole proprietors, nonprofit organizations, churches, and social clubs.

Supporting Our Communities

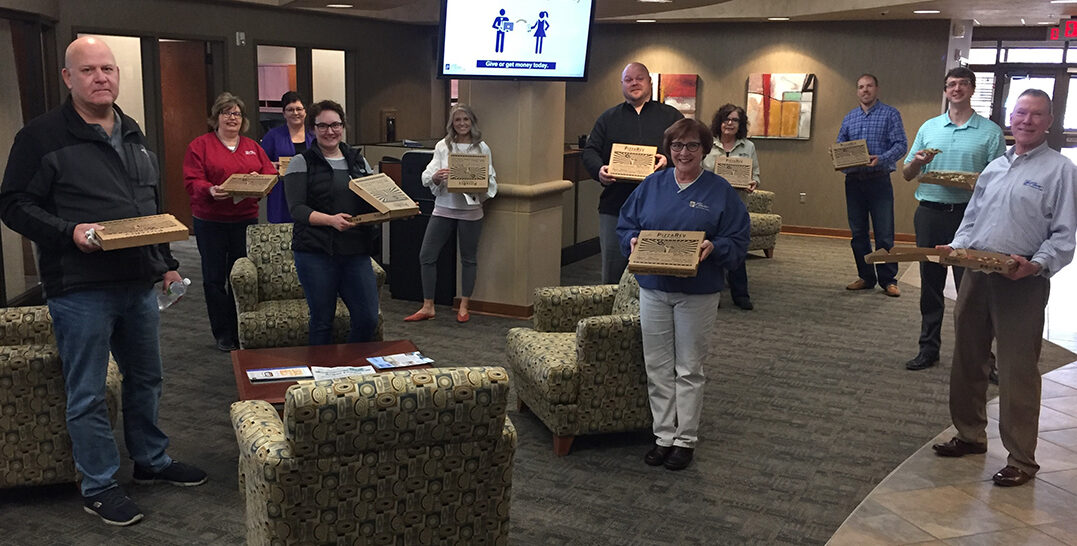

We're all in this together and we want to do whatever we can to help our communities. That's why you'll find us frequently grabbing take-out for our employees through what we're calling Lunchin' Locally. Or, you might even be asked to participate in a drive-up challenge if you visit us on a Friday.

Fraud Center & COVID-19 Scam Information

Expand the options below to view information on Coronavirus and COVID-19 scams. This information is provided by the new task force, the Better Business Bureau, and the Federal Trade Commission.

Government Relief Check Scams

Treatment Scams

Supply Scams

Provider Scams

Charity Scams

Phishing Scams

App Scams

Robocall Scams

Investment Scams

Price Gouging Scams

Misinformation & Rumors

FDIC Resources

- Read Frequently Asked Questions about COVID-19

- See the Workplace Guidance Plains Commerce is abiding by

General COVID-19 Resources

Check out these links for up to date information from the CDC & WHO: